What Is The Apprenticeship Levy?

Depending on the size of your business and the age of the apprentice you hire, there may be funding available to help you cover the cost of running an apprenticeship programme. This is in the form of an Apprenticeship Levy.

The Apprenticeship levy is a form of taxation introduced by the government to help fund their plans to increase the number of businesses taking on apprentices. The overall aim of the Apprenticeship levy is to help improve standards for apprenticeships across the country, making them a more attractive option for young people than full-on degrees. The levy is there to act as an incentive for more businesses to use apprenticeship provision as the main form of development within their businesses.

Funding Options

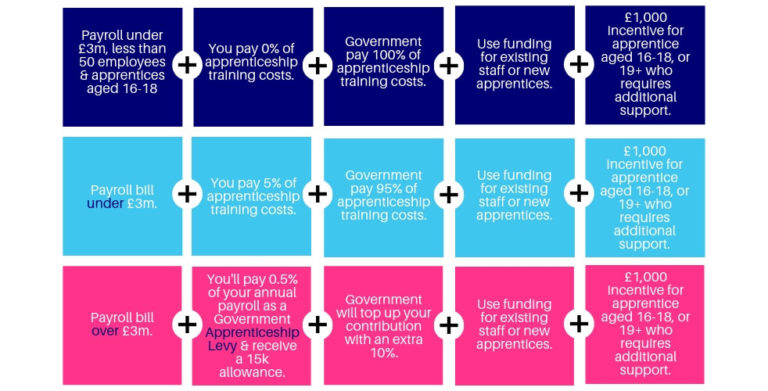

Small Businesses: Less Than 50 Employees

- The employer will have 100% of their training costs covered by the Government if the apprentice is aged 16-18

- If the apprentice is 19+, the Government will contribute 95% of the training costs and the employer will be required to co-invest 5% of the cost of training

- You will also receive a £1,000 incentive for hiring apprentices aged between 16-18

- The government have introduced the Apprenticeship Service Account (ASA) for all SME’s employers that will take effect from January 2020

SME’s: More Than 50 Employees

- The Government will contribute 95% of the training costs, regardless of the apprentice’s age

- You will also receive a £1,000 incentive for hiring apprentices aged between 16-18

Large And Enterprise Employers: Payroll Higher Than £3 Million

- The employer pays 0.5% of total payroll into the Levy pot

- Levy funds are then available for the employer to spend on apprenticeships through a new Apprenticeship Service Account (ASA)

- Employers have an allowance of £15,000 to offset against the Apprenticeship Levy

- A 5% Government top-up will also be applied

- Funds in your Apprenticeship Service Account will expire after 24 months

- Levy payers with insufficient funds must co-invest 5%

Incentives

It’s been confirmed incentive payments will be made to employers who hire an apprentice with a contract start date between 1st August 2020 and 31st January 2022. To qualify for the incentive payment, the apprentice must be a new employee and not have worked for the employer within the last six months prior to their contract start date.

However, another thing to remember is that apprentices who have a contract start date between 1st August 2020 and 31st January do not have to be hired as an apprentice, meaning employees who start in your business through normal recruitment channels and meet the eligibility criteria can attract the new hire incentives.

This makes the incentive a beneficial side effect of starting a new team member on an apprenticeship within their first few months of employment. There is no upper limit to the number of incentive payments an employer can claim, and two levels of payment are provided based on the age of the apprentice.

Why Choose Us?

We aren’t a massive fan of the expression ‘one stop shop’ but it does get across the point that we can deliver to all parts and all areas of your business! Thus saving you time, effort and money.

No tick boxes in sight! We actually train, coach and develop the people. We can even deliver modules remotely for anyone on the move. We use the best quality partners from BKSB to Onefile to help us pinpoint and differentiate our learning for each person. Learners can work on Smartphones, IPads, Laptops plus Employers can log in and check learner’s progress.

Did we point out we deliver world-class training and development? This is why most levy payers are interested in us as we can complement and connect the levy to the business need and help demonstrate and show real ROI.

If you have people development needs, get in touch today.

Can We Help?

Get in touch and complete the form below, we would love to hear from you!